Property Tax Rate In Yavapai County Az . yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). Treasurer's office responsible for the collection and apportionment of the personal and real. With a county median home value of $139,200, that means the average homeowner in. the average effective property tax rate in yuma county is 0.84%. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Yavapai county is rank 14th out. Annual tax statements are issued in the. the annual primary and secondary tax rates are based on the tax area code in which your property is located. pay or view your property tax bill. Home buyers & sellers property tax. The treasurer is responsible for the collection and apportionment of the personal and real property.

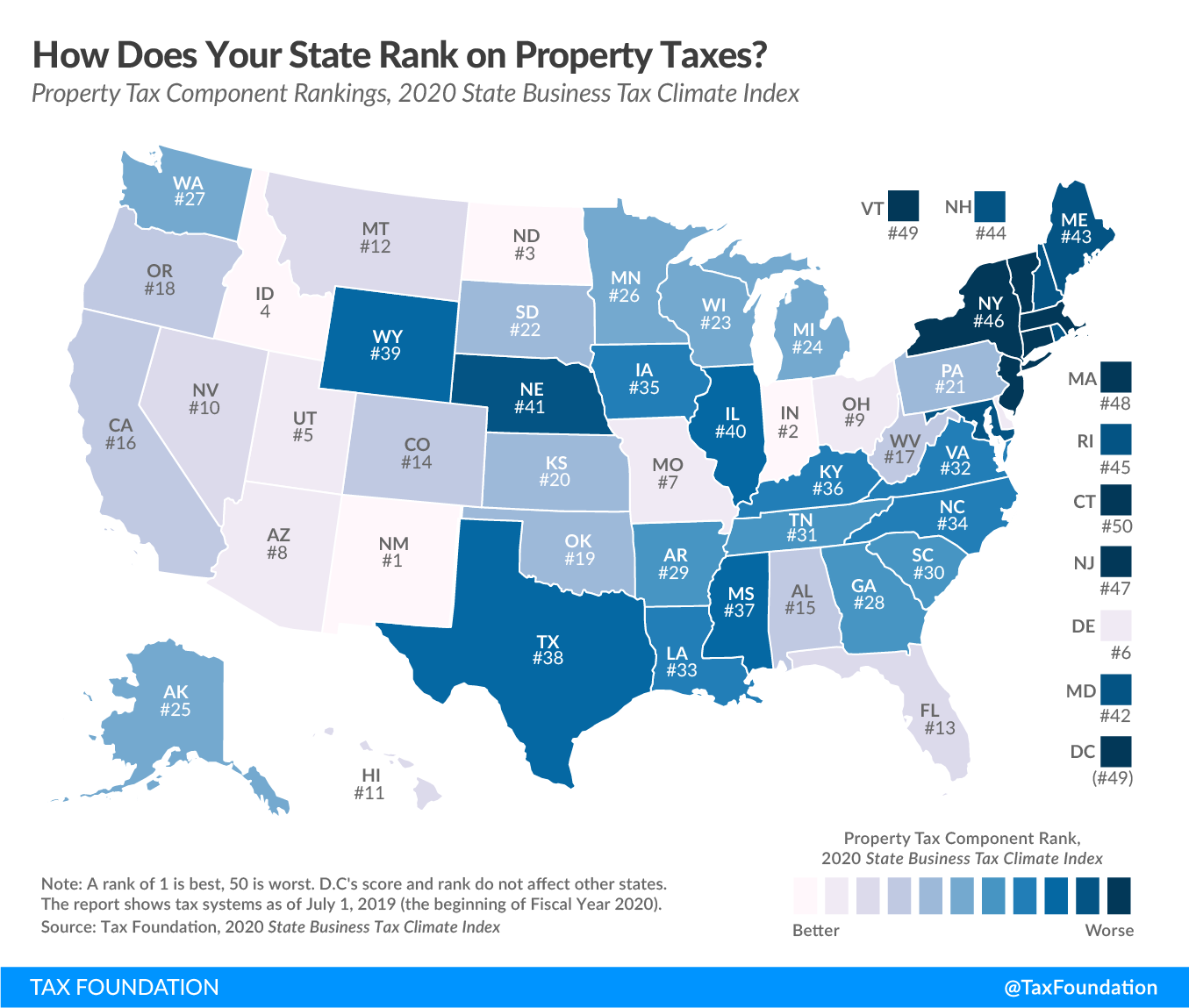

from taxfoundation.org

Treasurer's office responsible for the collection and apportionment of the personal and real. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the average effective property tax rate in yuma county is 0.84%. With a county median home value of $139,200, that means the average homeowner in. Yavapai county is rank 14th out. The treasurer is responsible for the collection and apportionment of the personal and real property. Annual tax statements are issued in the. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Home buyers & sellers property tax. the annual primary and secondary tax rates are based on the tax area code in which your property is located.

Best & Worst Property Tax Codes in the U.S. Tax Foundation

Property Tax Rate In Yavapai County Az Treasurer's office responsible for the collection and apportionment of the personal and real. the average effective property tax rate in yuma county is 0.84%. Home buyers & sellers property tax. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. the annual primary and secondary tax rates are based on the tax area code in which your property is located. pay or view your property tax bill. Yavapai county is rank 14th out. The treasurer is responsible for the collection and apportionment of the personal and real property. Annual tax statements are issued in the. With a county median home value of $139,200, that means the average homeowner in. Treasurer's office responsible for the collection and apportionment of the personal and real.

From www.eyeonyavapaicollege.com

County Property Taxes now provide 75 of Community College operating Property Tax Rate In Yavapai County Az the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Annual tax statements are issued in the. With a county median home value of $139,200, that means the average homeowner in. the annual primary and secondary tax rates are based on the tax area code. Property Tax Rate In Yavapai County Az.

From www.dcourier.com

County board to set property tax levy at Aug. 19 meeting The Daily Property Tax Rate In Yavapai County Az pay or view your property tax bill. the annual primary and secondary tax rates are based on the tax area code in which your property is located. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Yavapai county is rank 14th out. Treasurer's. Property Tax Rate In Yavapai County Az.

From eyeonhousing.org

How Property Tax Rates Vary Across and Within Counties Eye On Housing Property Tax Rate In Yavapai County Az The treasurer is responsible for the collection and apportionment of the personal and real property. Yavapai county is rank 14th out. Treasurer's office responsible for the collection and apportionment of the personal and real. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). Home buyers & sellers property tax. the annual primary. Property Tax Rate In Yavapai County Az.

From johnehlen.com

Yavapai County Map John Ehlen Property Tax Rate In Yavapai County Az The treasurer is responsible for the collection and apportionment of the personal and real property. pay or view your property tax bill. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a. Property Tax Rate In Yavapai County Az.

From taxfoundation.org

Best & Worst Property Tax Codes in the U.S. Tax Foundation Property Tax Rate In Yavapai County Az Annual tax statements are issued in the. Home buyers & sellers property tax. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the annual primary and secondary tax rates are based on the tax area code in which your property is located. pay or view your property tax bill. With a. Property Tax Rate In Yavapai County Az.

From www.eyeonyavapaicollege.com

County Property Taxes now provide 75 of Community College operating Property Tax Rate In Yavapai County Az Yavapai county is rank 14th out. Annual tax statements are issued in the. With a county median home value of $139,200, that means the average homeowner in. the average effective property tax rate in yuma county is 0.84%. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a. Property Tax Rate In Yavapai County Az.

From materialfulldioptric.z13.web.core.windows.net

Information On Property Taxes Property Tax Rate In Yavapai County Az The treasurer is responsible for the collection and apportionment of the personal and real property. Treasurer's office responsible for the collection and apportionment of the personal and real. pay or view your property tax bill. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value.. Property Tax Rate In Yavapai County Az.

From www.youtube.com

Yavapai County, AZ Real Estate Market Data October 2014 Coldwell Property Tax Rate In Yavapai County Az Treasurer's office responsible for the collection and apportionment of the personal and real. Home buyers & sellers property tax. With a county median home value of $139,200, that means the average homeowner in. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. the average. Property Tax Rate In Yavapai County Az.

From propertytaxgov.com

Property Tax Yavapai 2024 Property Tax Rate In Yavapai County Az the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. The treasurer is responsible for the collection and apportionment of the personal and real property. Treasurer's office responsible for the collection and apportionment of the personal and real. Annual tax statements are issued in the. . Property Tax Rate In Yavapai County Az.

From realestatestore.me

2018 Property Taxes The Real Estate Store Property Tax Rate In Yavapai County Az pay or view your property tax bill. the average effective property tax rate in yuma county is 0.84%. Yavapai county is rank 14th out. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Home buyers & sellers property tax. Annual tax statements are. Property Tax Rate In Yavapai County Az.

From countymapsofarizona.com

Yavapai County, Arizona Property Tax Rate In Yavapai County Az the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. Yavapai county is rank 14th out. Treasurer's office responsible for the collection and apportionment of the personal and real. the average effective property tax rate in yuma county is 0.84%. With a county median home. Property Tax Rate In Yavapai County Az.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Property Tax Rate In Yavapai County Az Annual tax statements are issued in the. Yavapai county is rank 14th out. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the average effective property tax rate in yuma county is 0.84%. The treasurer is responsible for the collection and apportionment of the personal and real property. the median property. Property Tax Rate In Yavapai County Az.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate In Yavapai County Az the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. The treasurer is responsible for the collection and apportionment of the personal and real property. the average effective property tax rate in yuma county is 0.84%. Annual tax statements are issued in the. Yavapai county. Property Tax Rate In Yavapai County Az.

From koordinates.com

Yavapai County, Arizona County Boundary GIS Map Data Yavapai County Property Tax Rate In Yavapai County Az Yavapai county is rank 14th out. the median property tax (also known as real estate tax) in yavapai county is $1,246.00 per year, based on a median home value. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the average effective property tax rate in yuma county is 0.84%. With a. Property Tax Rate In Yavapai County Az.

From propertytaxgov.com

Property Tax Yavapai 2024 Property Tax Rate In Yavapai County Az With a county median home value of $139,200, that means the average homeowner in. pay or view your property tax bill. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the annual primary and secondary tax rates are based on the tax area code in which your property is located. Treasurer's. Property Tax Rate In Yavapai County Az.

From taxfoundation.org

Ranking Property Taxes by State Property Tax Ranking Tax Foundation Property Tax Rate In Yavapai County Az The treasurer is responsible for the collection and apportionment of the personal and real property. With a county median home value of $139,200, that means the average homeowner in. pay or view your property tax bill. Treasurer's office responsible for the collection and apportionment of the personal and real. the annual primary and secondary tax rates are based. Property Tax Rate In Yavapai County Az.

From elatedptole.netlify.app

Property Taxes By State Map Map Vector Property Tax Rate In Yavapai County Az The treasurer is responsible for the collection and apportionment of the personal and real property. Annual tax statements are issued in the. Treasurer's office responsible for the collection and apportionment of the personal and real. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). Home buyers & sellers property tax. Yavapai county is. Property Tax Rate In Yavapai County Az.

From www.dcourier.com

County supes set tax rates on 241M budget The Daily Courier Property Tax Rate In Yavapai County Az Home buyers & sellers property tax. With a county median home value of $139,200, that means the average homeowner in. pay or view your property tax bill. the average effective property tax rate in yuma county is 0.84%. yavapai county (0.47%) has a 16.1% lower property tax than the average of arizona (0.56%). the median property. Property Tax Rate In Yavapai County Az.